I like listening to how different folks set up their cash, so right here’s a glimpse into my YNAB funds classes!

This one’s for the Finances Nerds!

This submit will most likely not attraction to nearly all of you who don’t use YNAB. However those that do – you’ll find it irresistible! This one is for the funds nerds on the market, like me. I LOVE the YNAB Finances Nerds Podcast hosted by Ben and Ernie. You’ll find it right here on Apple Podcasts, right here on Spotify, and right here on YouTube!

Final fall they aired an episode that includes Lee, who went line-by-line by his funds and shared his class construction together with every part from emojis to why he selected sure class names. I utterly geeked out over the episode. A lot in order that I emailed Ben and Ernie and instructed them I might enthusiastically like to be on the podcast to do the identical factor! A lot to my shock, they agreed, and this week we shall be recording the episode. I’ll allow you to all know when it’s printed!

What a funds tells you

Whereas a few of you might already be falling asleep at your desk, others of you is perhaps curious what’s so cool about seeing somebody’s funds. What you spend your {dollars} on displays what you worth. Whereas I received’t be sharing actual numbers (that will be the juiciest, wouldn’t it?!), by sharing my class teams, names, and spending plan, you may get a good suggestion of what I worth most. Furthermore, I’ve STRONG opinions about how I set up my funds. I hope you may really feel my pleasure on this subject wafting off the web page!

Our Family Snapshot

In case you’re new right here, right here’s a snapshot of our family to assist perceive our funds:

- Married couple in our 40s

- Two incomes, every small enterprise house owners (I’m a blogger; he’s a normal contractor)

- Two youngsters, ages 11 and 5

- Joint checking with a aspect account for Thomas’s enjoyable cash

- I’m the “cash particular person” so I do many of the YNABing!

What’s YNAB?

I’ve been utilizing YNAB since I used to be first launched in a sponsored submit alternative in 2016. Right here is my first impression submit and what I realized after 6 months of utilizing it. I even created our wedding ceremony funds in YNAB, and I take advantage of it for my enterprise bills, too. I completely love that it enables you to divide your cash right into a pie, plan for the long run, and know instantly precisely what cash is put aside for what aim. When you haven’t tried it earlier than, my hyperlink will get you a free month. I truthfully can not think about life with out it – I really feel that strongly!

How I set up my funds

I like to prepare issues, and organizing our joint checking account isn’t any totally different. Earlier than I begin to undergo my classes, I wished to take a minute to speak about how I set up my funds. I’ve listened to others discuss their class teams (on podcasts, YouTube, and so forth.) and I’ve tried a number of totally different methods: no teams (one lengthy alphabetical listing), teams by subject (meals, youngsters, pets), and teams by transaction sort or date.

Finally, I like mirroring Ramit Sethi’s tips in his acutely aware spending plan divided into: mounted prices, quick time period financial savings, guilt-free spending, and investing. These 4 buckets as percentages are an ideal guideline to comply with for a stable monetary place, and I like understanding the quantity we spend in every group off the highest of my head. Mix my month-to-month and annual bills collectively for mounted prices after which add financial savings and journey collectively for short-term financial savings.

My Class Teams:

- Financial savings (on the very prime, to encourage development!)

- Spending (all desires)

- Month-to-month Bills (wants, goes to zero every month)

- Annual Bills (wants, carries a stability every month, has a goal)

- Journey (all desires however wants its personal group as a result of excessive price when used)

- Adulting (holding / reporting classes that not often get cash assigned)

Typically these go down the web page from most to least used / vital:

- Financial savings will get the highest spot as a result of I wish to really feel probably the most motivated by it rising! I additionally assume the psychology of seeing it most frequently jogs my memory of my targets once I open my funds to spend.

- The Spending group is close to the highest for simple entry as a result of it’s the one I entry and spend from probably the most.

- The Month-to-month Bills group is usually automated, however I do verify to verify transactions are popping out and the balances are going to $0.

- The Annual Bills group will get the least motion as a result of these are lumpy / true bills which can be sinking funds for issues which can be needed and anticipated however as soon as or just a few instances a 12 months bills. I verify this part the least of the 4 talked about.

- Journey is close to the underside, but it surely will get pinned to the highest if we’re on a visit. Technically, that is a part of the short-term financial savings group, however I like to tug it out as a result of it’s so discretionary in comparison with money reserves.

- And the Adulting group is absolutely only a strategy to monitor cash that flows by my funds for taxes, investing, or reimbursements.

Emojis

Within the YNAB world, there are some sturdy opinions about the place the emojis go! I’ve to have mine on the finish of the road. I’ve tried the start and hated it as a result of it took my eye too lengthy to search out the phrase to learn. However I do love having the colour and image of an emoji there, so I’ve them on virtually all of my classes. The emoji is strategically chosen, after all 🙂

My YNAB Finances Classes

So let’s undergo every class group and see how the pie is break up up!

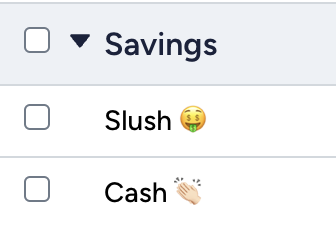

Financial savings

The Financial savings class group is on the very prime of my funds to be a relentless reminder of an important factor: saving extra! There are two essential buckets right here:

- Slush is the underside of my checking account. I maintain a base amount of money right here as a buffer in order that we’re by no means getting near $0 if all payments are paid on the identical day. I additionally use this Slush to cowl overspending after which prime it again off the next month. I like for it to be a good complete quantity in the beginning of the month so I’m much less tempted to take from it. That forces me to whack-a-mole (WAM) different classes earlier than taking from the slush.

- Money is our emergency fund – aka money reserves. I used to have it labeled emergency fund however seeing the phrase “emergency” on the prime of my funds was alarming, so I modified it to money which has a pleasant cozy and protected really feel! The aim for the Money line is for it to develop and for additional to get skimmed off the highest for non-retirement investments or enjoyable spending, like a visit.

This money reserves are held in a 5% high-interest financial savings account. Whereas I’m very pleased to be incomes curiosity on this cash, having a separate account to switch out and in of goes towards the simplicity I attempt to struggle for.

Our retirement investments come out of our paychecks / companies, so I don’t have a line merchandise for these on the prime, however I DO filter a few of them by our joint checking account as transfers (from my enterprise to my Solo 401k account or funding account) so I’ve a line in Adulting for Retirement for monitoring functions. See extra on that under!

Spending

Desires vs. Wants

Now the enjoyable stuff: Spending! I discussed above that my class teams are balanced between “desires” and “wants” as a result of I like to have the ability to know off the highest of my head what greenback quantity we spend per 30 days is discretionary. This helps me have an concept of what our baseline mounted bills are and what we may reduce out if we would have liked to. I’m consistently combating the stability of simplicity and knowledge. I’ve experimented with breaking our spending into sub teams and that simply difficult issues. All I actually need to know right here is that this complete group is discretionary!

The place is Thomas?

You would possibly assume that my husband has no enjoyable cash. Quite the opposite! He has a private checking account that will get funded every month immediately from his paycheck. Since he isn’t within the weeds of the funds everyday like I’m, it really works out completely for him to have his personal place to play. I by no means need to see his transactions, which is nice as a result of I’d most likely query all of them! Haha. He pays for haircuts, golf, items, lunches out, and toys together with his account.

Assigning Cash

This class group has probably the most variation month to month. Typically I don’t even fund a line (like Spa – that one will get the least consideration!). There’s additionally probably the most WAM occurring between these classes, stealing from eating out to purchase one thing, or most frequently not shopping for one thing as a result of we dined out an excessive amount of! I really feel strongly that these classes go to zero on the finish of the month in order that I can refund them the subsequent month and maintain our assigned cash even. My aim is all the time to have one thing left to roll into financial savings, however that doesn’t occur a lot.

Eating Out

At one level I attempted to divide up Eating Out into: Kath lunches, date nights, household meals, and bars and it was simply an excessive amount of dividing! I wished the info, however I didn’t wish to need to micromanage the classes, so I ended up rolling every part again into an enormous Eating Out class.

Household Spending vs. Actions

Household Spending contains purchases that profit us as a pair that aren’t needed purchases. Frivolous issues. Consumable issues like a brand new NA wine to strive. Tickets to concert events that we go to collectively, and so forth. Actions, alternatively, are family-friendly enjoyable issues we do with the children. Motion pictures. Ice cream (it’s extra of an exercise than a meals!). The trampoline park. And so forth.

Presents

Lastly, Presents is our giving class. We sponsor a household by Holt Worldwide and that may be a common expense. After which there are birthday/wedding ceremony/child bathe items. After which there are giving alternatives prefer to assist folks’s causes. That every one goes underneath this class. The 2 reward varieties that don’t go underneath listed below are Birthdays and Christmas – these are annual bills under!

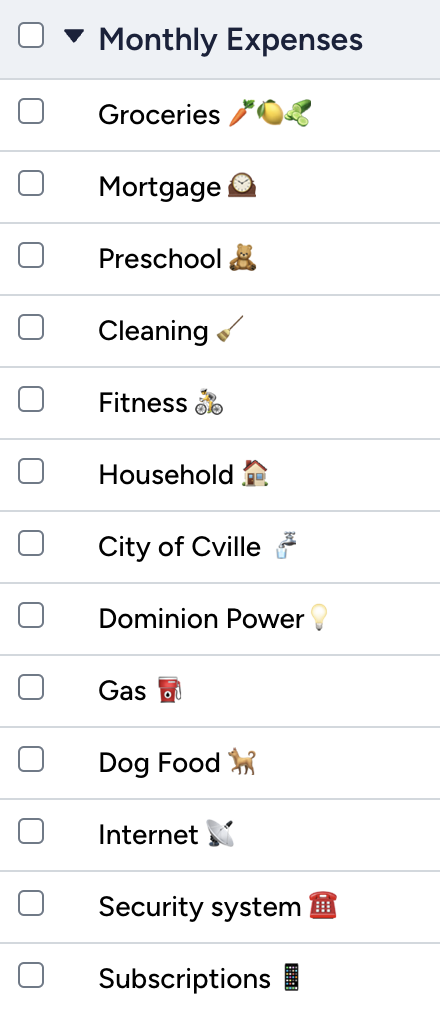

Month-to-month Bills

The Month-to-month bills group is about as boring as they arrive. The “huge three” are on the prime – Groceries, Mortgage, Preschool. We solely have just a few extra months of paying for preschool, and that shall be such an enormous celebration for the funds! These classes get funded fairly evenly month to month, and each class ought to be zero on the finish of the month. That’s how I can regulate what payments have been auto-drafted since most of those are auto-drafted. The one class that’s considerably flex in right here is Family, which is the place I put all 100% needed home purchases, like bathroom paper or laundry detergent. I’ve debated placing these with Groceries, however I do like maintaining the meals separate.

I’ve Health and Cleansing on this class which you will assume are “desires” not “wants” however they’re right here as a result of they’re the final issues we’d let go of in an emergency life scenario. Health covers our health club membership and Peloton which is totally different from the Sports activities class in annual bills under.

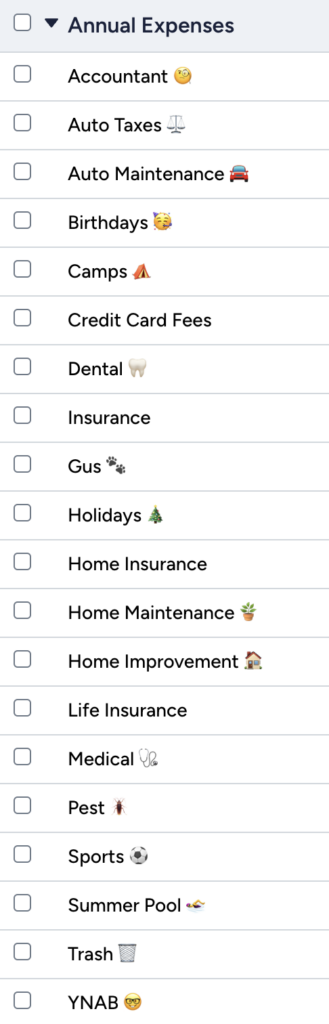

Annual Bills

This class contains all of the shock bills that shouldn’t actually be surprises! YNAB calls these lumpy, usually annual bills, “True Bills.” They’re sinking funds to pay for issues that you realize are coming (Insurance coverage each August! Christmas each December!). These are a mixture of desires and desires, however I’d say they lean on the wants aspect, so I contemplate them a part of my mounted bills.

Life is Lumpy

On Select FI, Brad likes to say “life is lumpy.” My aim is life is a easy funds with no lumps! Whereas after all there shall be some sudden bills alongside the way in which, if I can plan for it, I need to plan for it. We pay our accountant, auto taxes, bank card annual charges, insurance coverage, vet payments, pest management, summer time pool, trash and YNAB (!!) a couple of times a 12 months. I used to hate it when a “lumpy month” occurred. However since falling in love with YNAB, I’ve prorated every part! These classes all have a YNAB Goal set so I simply click on one button to fund 1/12 of the quantity I want every month.

Birthdays and Holidays

Extra lately I turned these into Annual Bills. Save $100 a month for 12 months and you’ve got the money for your entire vacation giving. The identical for our birthday season (This autumn!).

Dental and Medical

I’m not a type of individuals who retains their complete household deductible sitting in my medical funds. I normally see what appointments we now have developing and put some {dollars} in direction of them, plus one additional go to if somebody was sick. If we had been to have an ER go to or larger expense, I’d use my money reserves (emergency fund) after which work to replenish that after. For dental, I take the 4 of us and the price of our appointments and add them up, after which divide by 12.

Gus The Canine

I’ve the predictable pet food within the Month-to-month class, so this line is for something lumpy that Gus wants – his annual vet payments, flea medication, and a couple of weeks a 12 months of canine sitting after we journey.

Sports activities

I maintain sports activities and health separate due to the children’ sports activities. The health class in month-to-month is our health club and Peloton. We now have no intention of ever cancelling them. However this sports activities class covers registration charges for two adults of 12 months spherical soccer. After which the children charges are in there as properly for spring and fall.

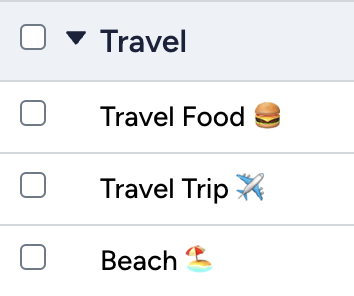

Journey

This might simply be grouped into Financial savings or Annual Bills and even the Spending group, however it’s separate as a result of it’s the one space the place I do prefer to have some additional reporting and it tends to be tremendous lumpy! We don’t journey each month, so I don’t need it cluttering the highest of the funds OR blended into the “wants” part as a result of journey is 100% a need. Thus, it will get its personal space. I’ve experimented with budgeting a month-to-month quantity to this class, but when we don’t have a visit deliberate, then I find yourself simply WAMing that cash elsewhere. So I don’t funds to this class till we now have a visit deliberate (normally at the least just a few months out).

Additionally as a result of we use bank card rewards for many of our base journey, the journey class isn’t as baller as it might be if we used all money! We’re largely budgeting for meals on journeys and a few incidentals for the journey half (airport parking, and so forth.) in order that’s why I separated out meals and journey.

Lastly, we do normally take a household seaside journey each summer time that may be a predictable, common quantity that I prorate all 12 months, in order that seaside journey will get its personal class. I wish to know that I can spend the journey journey to zero if I’m on one other journey and by no means wish to be doing psychological math to subtract out funds reserved. Seashore has been within the Annual Bills group earlier than, but it surely moved underneath Journey once I determined to get higher about stories.

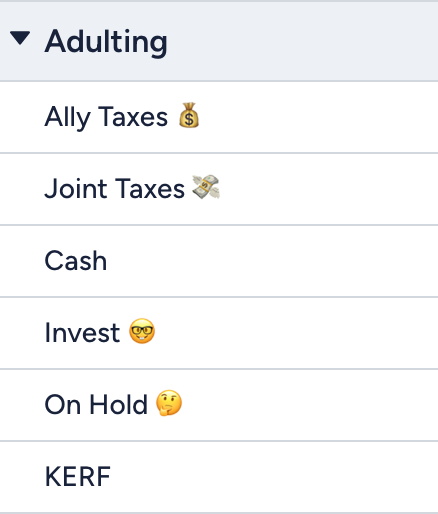

Adulting

Consider the Adulting class as a reporting / switch group greater than a gaggle the place I assign cash every month.

- Ally + Joint Taxes: The 2 taxes strains are for holding and paying estimated quarterly taxes for my enterprise. The identify signifies which account they’re in (I transfer them forwards and backwards from the Ally account as a result of that’s the 5% curiosity account! Typically I miss simply having one account at zero curiosity, hahaha).

- Money is money out of the ATM, which I not often get. If I do, it’s usually for a babysitter or a present, so it goes in that class. This money line is usually if I simply randomly get some out however don’t understand how I’ll spend it.

- Make investments is an apparent one – it’s any cash we ship to the funding account.

- On Maintain is a line merchandise for reimbursements. A number of years in the past I used to be in control of paying for the household seaside home and my fam venmoed me massive sums of cash. I didn’t need it to combine with mine, so it parked it in right here.

- KERF is a line merchandise in case a KERF expense runs by the private funds. It occurs.

Focus Teams

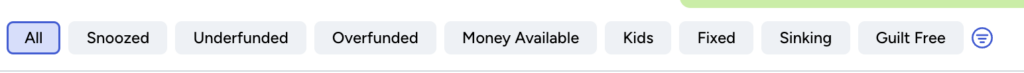

YNAB has a new-ish function known as Focus Teams, and they’re superior as a result of they can help you group classes collectively that you simply may need in a distinct group construction in your funds. I created a few of my very own:

- Youngsters bills – pulled from all totally different teams

- Fastened – combines month-to-month and annual bills

- Sinking Funds – all financial savings accounts and not using a clear expense timeline (aka Birthdays, Christmas, Automotive Upkeep)

- Guilt Free – pulls all of the spending from all of the classes regardless of the assigned group

I like those YNAB has auto-populated too!

There you could have it!

When you made it to the tip of this submit, nice job! You should be an enormous nerd like me!

When you’ve got questions on my classes, budgeting generally, or have sturdy opinions about why your construction is the most effective, please write a remark!